Subscribe to our email newsletter

Click here to receive notifications of new publications, upcoming events, and other NCIF announcements

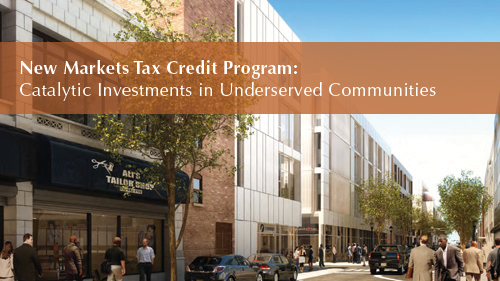

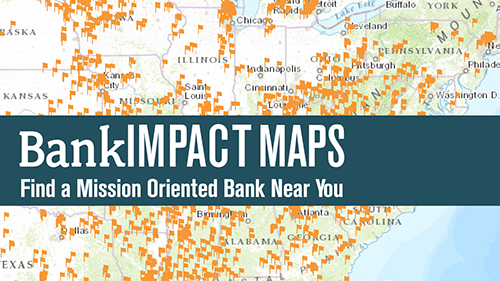

National Community Investment Fund (NCIF) is an impact investor and a 501(c)(4) nonprofit investment fund. NCIF invests in mission-oriented banks and other financial institutions in order to increase access to services and catalyze economic development in low-income and underserved communities. We support the mission-oriented banking industry by investing capital, creating innovative business opportunities, and facilitating the flow of funds from mainstream, philanthropic, socially responsible, and public sources. In addition, we supply research and impact metrics for banks and their investors and encourage collaboration through the NCIF Network. NCIF aspires to transform the financial industry so that responsible services are accessible to all and investments are valued based on social and environmental impact as well as financial performance. More about NCIF.